FM Deposit Hold See SM: Understanding the Importance of Deposit Holds in Financial Management In the world of finance, deposit holds play a crucial role in ensuring the stability and integrity of financial transactions. The acronym FM, in this case, stands for financial management. Understanding how deposit holds work is essential for individuals and businesses alike, as it can impact their cash flow and overall financial health. In this article, we will delve into the intricacies of deposit holds and shed light on why they are important in financial management. A deposit hold refers to the practice of delaying the availability of funds deposited into an account. When you deposit a check or cash into your bank account, there is a certain period during which the bank may place a hold on those funds. This hold serves as a safeguard against potential fraud or insufficient funds on the part of the depositor. It allows the bank to verify the legitimacy of the funds and ensure that the account holder has sufficient funds to cover the transaction. Deposit holds can vary in duration depending on various factors, such as the amount of the deposit, the type of account, and the relationship between the depositor and the bank. The hold period can range from a few hours to several days, during which the funds are temporarily unavailable for withdrawal or use. It is important to note that deposit holds primarily apply to checks and not direct cash deposits, as cash is considered to be immediately available funds. Now, lets explore the significance of deposit holds in financial management. One of the main reasons for implementing deposit holds is to protect both the bank and the account holder from potential fraudulent activities. By placing a hold on funds, the bank can thoroughly review the deposit and ensure its legitimacy. This reduces the risk of processing fraudulent checks or accepting deposits from accounts with insufficient funds. Deposit holds also serve as a risk management tool for banks. They allow financial institutions to mitigate the risk associated with bounced checks or fraudulent activities. By delaying the availability of funds, the bank can conduct the necessary due diligence to verify the authenticity of the deposit. This protects the banks reputation and ensures that its customers funds are safeguarded. For individuals and businesses, deposit holds can have both positive and negative impacts on their financial management. On the positive side, deposit holds provide a layer of security by reducing the risk of accepting fraudulent checks. This can prevent potential financial losses and help maintain the integrity of their financial records. On the negative side, deposit holds can temporarily restrict access to funds, which may disrupt cash flow and hinder financial planning. For businesses, this can be particularly challenging, as they rely on a steady flow of funds to meet their day-to-day operational expenses. Understanding the duration of deposit holds and planning accordingly can help businesses mitigate the impact on their cash flow. To optimize the management of deposit holds, individuals and businesses should be aware of the terms and conditions of their bank accounts. It is important to review the account agreement and understand the banks policies regarding deposit holds. This knowledge will help in planning daily financial activities and avoiding any unexpected disruptions caused by deposit holds. Additionally, maintaining a good relationship with the bank can also be beneficial. Banks may offer certain exemptions or reduced hold periods for trusted customers or for accounts with a history of good standing. By establishing good communication with the bank and demonstrating financial responsibility, account holders may be able to negotiate shorter hold periods or exemptions for certain types of deposits. In conclusion, deposit holds are an essential component of financial management. They provide a necessary layer of security for banks and account holders, protecting them from potential fraud or insufficient funds. Understanding the duration and impact of deposit holds is crucial for individuals and businesses to effectively manage their cash flow and financial planning. By staying informed and maintaining good relationships with their banks, account holders can optimize the management of deposit holds and ensure the smooth operation of their financial activities.

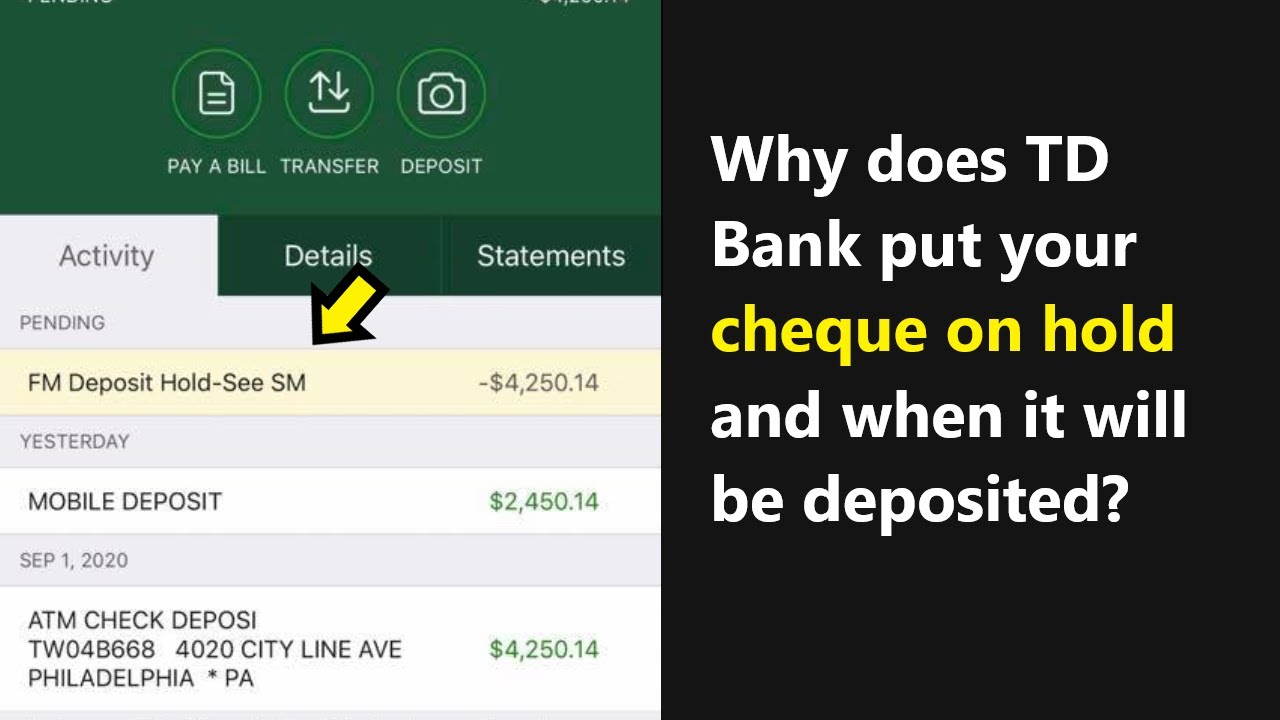

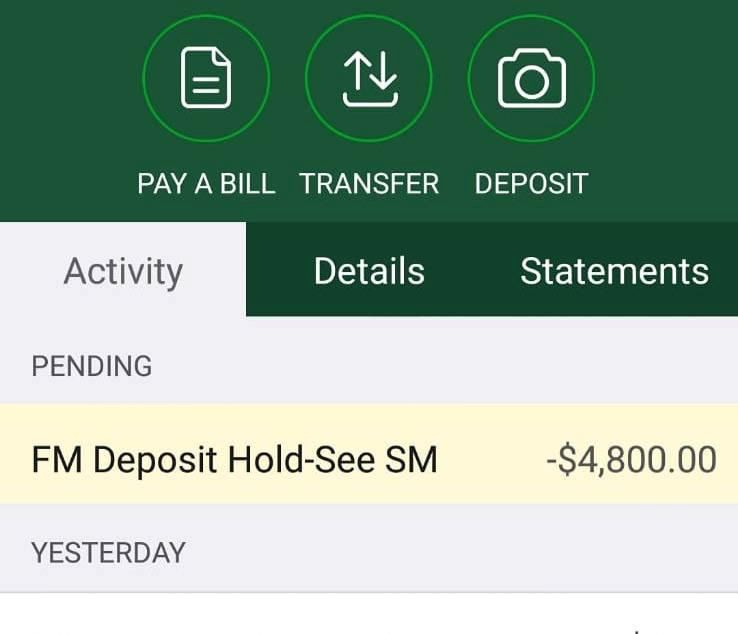

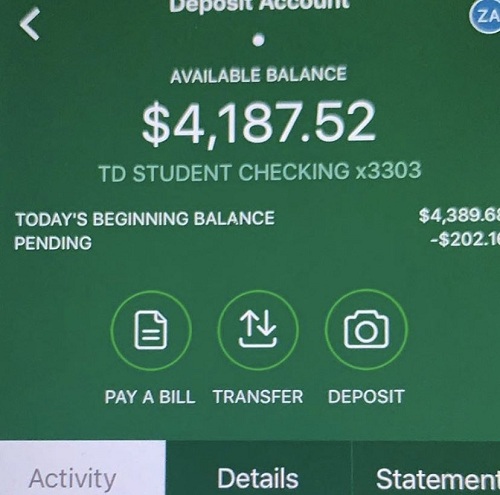

Why does cheque pending with "FM Deposit Hold-See SM . - YouTube. If you deposited a cheque into TD Bank account and its pending with "FM Deposit Hold-See SM", then watch this video to figure out what does it mean and when your funds will be available to use!.. FM Deposit HOLD SEE SM - What Does It Mean? - Project Financially Free. Youll find FM Deposit HOLD SEE SM in your TD Bank mobile app next to a check deposit awaiting clearance. This means the bank is yet to fully confirm and clear your payment (s) into your accountuk amateur sluts fucked

. This message and hold will typically occur for long periods if you deposit checks on non-business days.. Bank putting checks on hold for excessive amount of time. In fact - they all had a hold on them and were marked as "FM Deposit Hold- See SM"cheap customized giveaways

. When I went to my local TD Bank I was told that they could do nothing about the holds on the deposits and that they were scheduled to go through by the 28th, next Wednesday! Thats 9 business days from when the first batch of checks were deposited!. FM deposit hold-see SM — Here is what it means fm deposit hold see sm. If any of your checks are marked as "FM deposit hold-see SM" then it means that there is a temporary hold on the checks. Even if you visit a local TD Bank, you may be told that the deposit is scheduled to go through on a stipulated date and that there is nothing they can do about it fm deposit hold see sm. What to do when FM deposit hold-see SM reflects on your statement fm deposit hold see sm. What Does Fm Deposit Hold-see Sm Mean? - CGAA. The fm deposit hold-see sm mean is the amount of money that the FDIC insures in a bank account. This amount is typically $250,000 per depositor, per FDIC-insured bank, although it can be higher depending on the specific accou nt type and how the account is structured.birthday freebies at amusement parks

. Unlock the Mystery: What Does FM Deposit Hold Mean at TD Bank . fm deposit hold see sm

john deere 100 series belt replacement diagram

. FM Deposit Hold-See SM - What Does It Means? - Centralfallout. FM Deposit Hold-See SM: The TD Bank mobile application can be a great tool to manage your money fm deposit hold see sm. It can be used to deposit checks, check balances, transfer money and many other things fm deposit hold see sm. There are some things you should know before using it fm deposit hold see sm. Verify That Your Deposit Is In Accordance With Bank Policy fm deposit hold see sm. Whats FM Deposit Hold-See SM? — Here is what it means - Cinogist.com. Whats FM deposit hold-see SM? You are receiving this message on your account statement because you attempted to deposit a check (s) using the TD Bank mobile deposit app, but it was unsuccessful. This hold may be placed on your transaction if you attempted this on the weekend.. What Does Fm Deposit Hold Mean? - CGAA. Shortcuts What is fm deposit hold? What does it mean? How does it work? Most money market accounts require you to keep a minimum balance, and if you fall below that balance, you may be charged a fee. Money market accounts may also have limited check-writing and debit card privileges.. So I deposited a echeck on Friday : r/personalfinance - Reddit. What does FM Deposit Hold-See SM mean and how long is the hold? This thread is archived New comments cannot be posted and votes cannot be cast 0 4 comments Best [deleted] • 2 yr. ago You should be aware that there is a high probability that you are being scammed if somebody sent you a picture of a check to deposit.. FM Deposit HOLD-SEE SM Meaning: FAQs Answered - Wealth of Geeks fm deposit hold see sm. Conclusion: FM Deposit HOLD-SEE SM TD Bank FAQs

when you want to fuck but hes not home

. A "hold" is a situation in which funds are not available for a short period. This status was created by the bank so that you can use the money even though it is still in .. FM Deposit Hold-See SM: Understanding the Process and its Importance .. An FM deposit hold-see SM is a process that financial institutions use to hold and monitor deposits made by their customers fm deposit hold see sm

gay pussy fuck

. Related Article: Hold Memo dr Why did I get the "FM deposit hold-see sm" message?. What is The meaning of "FM deposit hold-see SM" ? (Dont Panic). FM deposit hold-see SM is a term used by banks to indicate that a deposit has been made, but that the funds are not yet available for use. SM means Special Mention, and denotes why the deposited funds are not available for usenational geographic sweepstakes 2017 wyoming

. This is usually due to the bank needing to verify the deposit, which can take a few days (each bank is different).over 30 sex dating

. FM Hold Deposit SEE SM: Reasons and Motive! - GOOD CHRONICLE. salina March 13, 2021 FM hold deposit SEE SM means holding funds in your bank accounts fm deposit hold see sm. You will get this in your account statement when you try the TD bank mobile app to deposit some check (s), and if the cheque did not go through when you deposit a cheque or deposit through ATM using TD mobile deposit from your bank account.. BANK QUESTION about "Fm deposit hold- see SM" - Frank Radtkee. The money from the check is now in my pending activity section and it says "Fm Deposit Hold- See Sm"dispensary new river

. Before making this post, I did do some research and it seems to be theres just a temporary hold on the money and the bank is making sure that the person who sent me the check actually has enough funds in their account (which they do).. FM Deposit Hold-See SM: The Real Deal On Getting Paid. FM Deposit Hold-See SM is an international company that deals in multiple forms of funding. This company is a reputable name for businesses looking for loans and other avenues to receive funds from their clients. They have offices in the United States, Canada, Europe, Central America, Africa and South America.